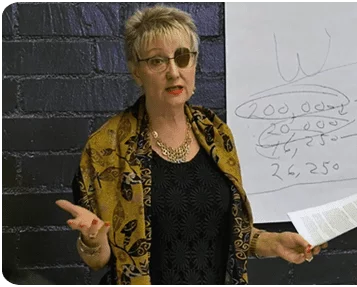

Raising money for independent films is the number one pain point for almost every filmmaker in the world. A buzzword so many producers hear nowadays is “film tax credits.” These tax credits are magical and it’s like money falling from the sky but how do they work? How can indie filmmakers get their hands on these greenbacks?

Hopefully, this episode will make that struggle a bit easier. On the show today we have tax credit guru Zachary Tarica, CEO of The Forest Road Company and Chairman of the Board & Chief Investment Officer at Forest Road Acquisition Corp.

The Forest Road Company (FRC) is a vertically integrated, specialty finance platform catering to the entertainment industry. Through tax credit lending, servicing, and brokerage, the team of finance professionals, tax credit experts, and lawyers work to empower responsible creators with the resources they need to bring their best work to life.

The company has also sponsored its first SPAC (special purpose acquisition company), Forest Road Acquisition Corp., which went public on the New York Stock Exchange in Nov 2020.

In its three years of business, Forest Road has remarkably funded over 150 projects in film and TV through tax credits and raised a staggering $300 million capital – working with state and federal officials and filmmakers to build independent filmmakers competition with big studio films.

Zachary had previously built a career in the private equity business. So when he was introduced to the filmtrepreneur side of the industry, he saw an opportunity to capitalize on a cost-effective, double-win, where filmmakers would avoid the bad distribution deals and States would benefit from the jobs created.

I consider this episode as one of the ultimate film business talks. With the challenges COVID has caused to every industry, the film industry is dealing with hurdles of the high replacement costs to make movies.

Being able to properly get allotted film tax credits is a massive advantage. Zachary shares prime investor insider knowledge and resources in this conversation that will blow your mind. And of course, you have to hear his hilarious story of how he discovered the Indie Film Hustle Podcast and my book Rise of the Filmtrepreneur.

Enjoy my conversation with Zachary Tarica.

Right-click here to download the MP3

Alex Ferrari 2:31

So I was very fascinated to talk to our guests today. Zack Ricca. Now Zach runs a company called forest road, and his company has raised over $300 million worth of capital and funded and brokered over 150 Film and Television projects exclusively using state Motion Picture tax credits. Now the world being what it is, today, it is tougher and tougher to make a major motion picture and an independent level. And we can use any little help we can get. And Zachary and I go deep into the weeds about how independent filmmakers can gain access to these tax credits around the country. And by the way, not only in the US, but there's tax credits around the world, different countries have tax credits as well. And we're going to go into all the details of what tax credits are, how you can get them how you need to properly get them and how not to get in trouble. Because I even tell a story of a few filmmakers that I've worked with in my career that got into a little bit of trouble when they did things that they shouldn't have been doing with t ax credits. So without any further ado, please enjoy my conversation with Zack tariqa. I'd like to welcome to shows actor rica man How you doing?

Zachary Tarica 3:57

I'm doing great. How are you?

Alex Ferrari 3:58

I'm good, man. I'm good. Thank you for being on the show. Brother. I truly appreciate it. We're going to talk today about tax credits, something we have never truly dug into in the podcast, which is a rare thing. Since we have over 400 plus episodes. We've covered a lot of stuff in the show. And I've never had an episode on tax credits. And I've talked them I've talked about them a little bit here and there. And I know I'm I know enough about tax credits to be dangerous. So I really wanted to bring an expert on to the show. But before we do that, how did you get involved in this ridiculous business? Sir

Zachary Tarica 4:37

How did I get involved? Well, thanks. Thanks for having me. And I've been I've been a fan of this and I'm glad we were able to make it work. I was working at a private equity firm, and I was spending a lot of time on tax credits. And I kind of fell into this. It's the classic story of a friend asking you to invest in a movie and me wanting to learn more about the different parts of it just because I'm a generally curious person. And I started digging into how tax credits were different in film, versus renewable energy and real estate. And ultimately found that there was a community of people like yourself, I think that that are film sharpeners. And, and dangerous in the tax credit game, but not really maximizing the value of the tax credit and how important the tax credit can be in your project. And so like anything else, when you go to buy something, or build something, capitalizing it properly is very important. Not taking too much debt versus having way too much equity and finding that equilibrium and balance. And I found that tax credits, allow for the win win win, right? We as a company, we win because we're helping filmmakers create their project. And we're also making money, right? I don't want this to be about why we're the Robin Hood company of this industry, we definitely make money. And the second part is, this process allows for us to win as a company, the filmmaker to win but most importantly, these states that have good programs, they're winning the with with an election coming up, and 2020 and America in the position it's in in the world. Job creation is probably one of the most bipartisan issues out there right now. And tax credits do a remarkable job of creating jobs. And that is the third winner in this, which is these states rely on our company to do things in accordance with their rules and regulations. And the filmmakers are relying on us to help them not only do it the right way, right, get that tax credit back or that rebate back. But they're also relying on us to maximize that value for them. We've had filmmakers come to us and say they have a tax credit worth $100 I'm using a fake number. And in reality when we get under the hood and do the work that tax credits were $300. And that means the world for them to not have to go and raise that extra hundreds of 1000s of dollars from equity. Or take the bad distribution deal that that I know, you might have so many times

Alex Ferrari 7:41

there's that there's bad distribution deals, what are you talking about?

Zachary Tarica 7:44

So never did one such thing

Alex Ferrari 7:45

stop that. Saying stuff

Zachary Tarica 7:50

But um, but But yeah, in short, I fell into this by accident. I'm excited to have fallen into it. The company that I worked at is called Forest Road. And it's been a great, almost three year run now at this point, being able to work with both elected and local officials at the state and federal level. But also to work with a lot of different filmmakers watching their projects and their their business, which is their film come to life.

Alex Ferrari 8:25

I love that last statement their business and their film because a lot of filmmakers don't think of their film as a business. They think of it as a creative outlet, which it is, but as I've said many times before, is there's twice as many letters in the word business as the word show. And there's a reason

Zachary Tarica 8:42

if they don't if your listeners don't know that by now they need to fix their air pod.

Alex Ferrari 8:47

Absolutely. And really quickly, I always like to ask, and we talked a little bit about this off air, how did you find me and the work that I'm doing and with indie film, hustle, I'm always curious.

Zachary Tarica 9:00

Pride myself on letting our customers know that I'm getting an industry, I'm not going to read a script. I'm not going to get into the creative chops of it. That's what that's what our team is there for. And the same way that I wanted to dive into the film tax credit side of it. I also wanted to dive into the film side of it, less the tax credits. And so I travel a bunch, obviously pre COVID and, and I'm always looking for the next good book or podcast. I came across your podcast. Um, and and actually I don't it's it's a funny story. I came across this podcast and every time I went to listen to it, I was on a flight and the flight every time three for three the first three times I literally hit play sat in my seat, put my seatbelt on and the plane would get canceled the flight would get and I was just like you know what, screw it on. done listening to this guy, head, it's bad juju. It's bad karma on the done. And it took a little bit of time. And in the earlier part of this year, I was home. And I was on a bike ride and I listened to some more of the episodes. Fortunately, not nothing got canceled or any muscles during my workout were you and then I heard you read off the first chapter of the book Rise of the film trip earner. And I quickly sent it around to the team on our end. And I, you know, told everyone that they should order the book and they should listen to this chapter, we were looking at a lot of different things in the space distribution deals and mg lending and presale lending and what was going to happen with international sales in the midst of the earlier parts of the COVID pandemic. And it just was very well received by our team, it was very informative, it helped answer a lot of questions that I think there are people out there spending hundreds of 1000s of dollars, either in losses or in education that they can get for the free admission of your podcast. And I believe the sub $20 investment of the book. And so I just, I love promoting things that I use myself and look into myself, and use myself. And this was one of those things. And so it was an easy reach out for me. And ultimately what I was doing was I was connecting our clients with you, you know, they would ask us about how should we think about, you know, raising money for this. And I was like, you should actually look at chapter three of rods of the film group runner, you know, I have to buy the book. And so that that's how I came across. And I think this business today, trying to launch your business, ie your film, you have to, you know, give give your vote or read. And there's so many of these podcasts that will save whoever it is hundreds of 1000s if not millions of dollars over the course of their career, hopefully their long career in this industry.

Alex Ferrari 12:23

Well, I will make sure to send you a check for that endorsement, sir. I appreciate that very, very, very much. Now, really, so let's get into it. What are tax credits? A lot of people don't understand what a tax credit is.

Zachary Tarica 12:35

Tax Credit is in its simplest form, we'll we'll start really high level and then we can get a bunch more in the weeds. a tax credit in its simplest form is something that you're doing to benefit the state in which you're doing it. So what did I just say? I kind of just said nothing. So the tax credit is there for you to get something back. You're you're helping someone do something. So you decide you want to make a movie. So let's just use a real life example. Alex tomorrow wants to make a movie in New York,

Alex Ferrari 13:14

a vegan chef, a vegan chef movie star, a vegan chef romantic comedy.

Zachary Tarica 13:18

Correct? Correct. And so, when Alex looks to make this movie, he's going to raise two types of capital, equity and debt. The debt has a lot of different pieces to it. And we'll put that aside for now the equity. Let's just use the example of friends and family to make this illustrative and simple. On the equity side, he calls 10 friends and they all give them money. Great. Alex is a good friend and everyone was happy to chip in and see this vegan chef, New York romantic comedy come to life. On the debt side, there are I'll just define as a bucket of pre sales and tax credits. tax credits are there to help promote things like tourism, this vegan chef romantic comedy movie is going to start off at the Empire State Building. He's going to fall in love at Madison Square Garden. He's going to go on his engagement proposal trip to the Natural History Museum. And then ultimately, this all will culminate with him finding out that the love of his life wasn't vegan the entire time at the Statue of Liberty and the end of the movie and you'll be left hanging on the edge of your seat to see if they end up making it work or not in the sequel.

Alex Ferrari 14:46

That's a horrible, horrible story pitch. Sir. You obviously are not in the film industry. Sir. You are. You are a finance guy. Through a through sir. That's a horrible, horrible

Zachary Tarica 14:58

That was my first pitch. That was my first pitch.

Alex Ferrari 15:00

Yes, sir. Horrible continue.

Zachary Tarica 15:04

The tax credit is there to promote New York, right. So Alex is going to bring a lot of jobs when he shows up on day one in pre, principal and post and we could talk a lot about COVID. Now, because the opportunity and replacement cost of making content is becoming more expensive. It today is more expensive to make a movie because of the Coronavirus, then it is to or was prior to February 25 2020. And so the tax credit gets allocated towards your hotel stay your transportation, your flights, the soundstage grip and lighting, the post production VFX the below the line and above the line expenses. Now every state has its different rules. So I name things that may not qualify for New York. But the important part here is you are spending money to earn a tax credit in the form of New York, it's a rebate so they actually just cut you a check. So here's a real example. Well, we'll do a little bit of math, which I know you like to jump into. On these, you've got a film that's being made for a million bucks. You've got 500,000 or half the budget, that's going to qualify for the rebate, and the rebate is 30%. So 500,000 times point three is 150,000. If you do everything the right way, which no one ever does, and even if you do, the state will not tell you you did it the right way. You will get back $150,000 making your vegan romantic comedy chef movie in New York. Why is that important? That is $150,000 of found money. It's money, you don't have to borrow from your dentist or your friends, it's money that you don't have to take from a distributor who may not have the film's best interest in their agenda. It comes from the state and the state is paying out 30% because you just created jobs, tourism and infrastructure. And so the tax credit in its simplest form is a thank you from the state you're shooting for creating those things for that state.

Alex Ferrari 17:41

Simple as that.

Zachary Tarica 17:43

Simple, it's as simple as that. The problem with tax credits is because it is so fairly simple. Everyone thinks they're an expert in it. Right? It's, it's like any other part of this industry. Um, because everything that I said, I hope would make sense for a fifth grader, everyone now becomes an expert on tax credits. And so you start to miss things. And I'll give a great example of missing something. You buy a whole bunch of stuff from Walmart, you go to the store and you buy it, and it qualifies for the tax credit. However, Alex, this time you messed up, instead of going to the store and buying it from the store, you order it on walmart.com and you ship it to the store. You no longer get the tax credit based on what you shipped. So every state and every year has its own intricacies has its own restrictions has its own rules. And you're not dealing always with elected officials. You're not always dealing with the right person at the Department of Revenue, or Revenue and Taxation or the Film Commission. You're dealing with a lot of people hearing a lot of things with constant law changes. So what we do as a firm is make sure that everything is done the right way. And ultimately what that right way means is we're maximizing the value of the tax credit. We're working hand in hand, not with what someone at the Film Commission tells us now with what your cousin who once made a movie in Pennsylvania two years before you told you what to do, we're doing this so that everything happens such that you maximize the value you get the most amount back on the tax credit, but also you're doing it the right way with the state and that happens faster. And and so another big thing that I know you like to discuss on this show, is the time value of money right? What is $1 worth today versus $1 worth in two years from now? We had a call today with someone waiting on a New York tax rebate from 2014. What is that money even worth any more to that person. So we're constantly doing these so that we can push the envelope and get this done as fast as possible. Because ultimately, with debt comes interest and with interest comes losses to your equity. And our goal is to maximize not only the value of the tax credit, but the value of your business, ie the film you are making.

Alex Ferrari 20:39

Now, each state obviously has different rates. And some states don't have tax credits, or tax incentives as they're as they're called. I remember when I used to live in Florida, Florida for a while, had a good tax incentive. But then a different party came into play and they killed it. And then with that killed all of the all the production that was going down in Miami and South Florida, because I remember when I was growing up, there's bad boys bad boys to try. I think transformer there's a ton of movies that went down there, to the point where they just when they made bad boys three, they shot just the bare essential exteriors and everything else they shot up in Georgia, why tax incentives? Which, arguably, Georgia now has is it's the best in this in the content of the country, one of the best.

Zachary Tarica 21:28

Georgia is the Hollywood of the South. Right, no question about it. The most prolific program highlighted by the investments that have been made by Disney and Netflix and and be bang for your buck you get there is great. No, no question about it. That is not to say that there are not a lot of other states that are in line with Georgia, or their goal is to, you know, overtake Georgia in that program. Right? New Mexico has made tremendous investments in their tax credit programs. Pennsylvania, Massachusetts, New York, Oklahoma, Alabama, Mississippi, what we do as a company is, in going to our website, we actually rank every state that has a program. And if you click on that state and type in your email address, we will send you a one page cheat sheet on everything you need to know in that state making a movie. So what we want to do is help filmmakers get to the right place for their project, every project is different. And so just because Georgia is the program to be in right now, that doesn't mean Georgia's the right program for your film. And so maybe, if you're based in Los Angeles, with everything going on in the world, Georgia doesn't make a lot of sense to be on flights back and forth, maybe you want to look into Puerto Rico, maybe if you're coming from New York, it doesn't make sense to shoot in New Mexico, it may make sense to go to Alabama, so every one of these programs constantly change. And so it's important to stay on top of that. And that's what we do as a company. But it's also important to know what your film is and what you're doing as a business such that you're shooting in the right seat for your project.

Alex Ferrari 23:33

Got it? Now, do you also work with international? Um, like, you know, because there's incentives in the UK in different countries? Is that something you guys work with? And can you talk a little bit about that it was basically the same concept as it is here in the States.

Zachary Tarica 23:47

The core vision or mission statement of our company is to add value is to help our clients. If you're, if you're if you're calling us, because you're really excited about a program in Romania, and you're exploring shooting there and earning those remaining credits, you will hear me quickly say you should probably work with someone else, we can't add value we can't help. So we work in jurisdictions where we can help in Canada, in the UK. Now in some parts of Latin America, where we not only know the programs, but we know the people within the programs to move things faster. The underlying programs are virtually the same, right? They're in place to do a bunch of different things tourism, infrastructure and job creation. We will turn down more projects outside of North America than we will take Because ultimately, we just can't add as much value.

Alex Ferrari 24:50

Alright, fair enough. Now, as with everything we're talking about with tax credits, the thinking and the concepts very similar. You spent $100,000 there, you're going to get 30% back so you're going to get $30,000 Back in that's a very generalized way of looking at it. Is there a way to leverage tax credits to help get financing saying like, Okay, guys, we have a million, this is a million dollar. This is a million dollars, but we really only need 700 1000. Because we qualify for a million dollars because we're going to do everything in Georgia. Where is it Georgia production, everything, we're not going to breathe outside of Georgia. So that means we know that 30,000 $300,000 is coming in. So when raising the remaining 700,000, can you leverage that 300,000 to help you get the financing?

Zachary Tarica 25:40

That's the biggest, that's that's the biggest thing, right? So what we want to do is make the cost of capital of the film as low as possible. So in that example, that you just gave a million dollars, where you only need to raise 700,000, because 300 can come from the tax credit. That's a home run, win win win scenario for all right? And so what were you going to do, if you didn't raise that extra 300,000, what were you going to do, if you had 700, making a million dollar film with that 300,000 coming in from the next one, it would have come at the expense of higher interest debt, it would have come at the expense of a bad potentially mg deal, it would have come at the expense of you know, less shooting days, it would have so the beauty in what we're doing is we're actually a capital provider. So we're coming to you saying look, you thought your tax credit was worth 300,000, we actually think it could be worth 400,000. And we're giving you that we're putting our money where our mouth is 100% of the time. So I believe in the ability to show you know the buy in buy action, not words there, you know, any one of them that I could point you to a long list of people that will tell you what your tax credits worth, I cannot point you to a long list of people that will actually put the money up for what they tell you it's worth. So when you get a number from us, that's a number not that we're going to go take to the bank, not that we're going to go do anything else with that we as a company that we're going to put the money in, we're investing that. So if you're looking for capital against tax credit, we are the one stop shop for not only maximizing the value, getting it back faster, brokering the tax credit, which is something we haven't hit on yet. But also lending putting capital in your pocket immediately.

Alex Ferrari 28:01

Now, how can how can the tax credit? If the state gives 30%? How can that tax credit be worth more than 30%?

Zachary Tarica 28:09

Well, it's worth 30%, on what qualifies. So you've got the numerator and the denominator. And the most important part is getting the qualified number, right? Because no matter what you're going to multiply by point three, whether or not you multiply by a million or 500,000. That's the differentiator. Oftentimes, the difference between 500 grand and a million is the fact that the filmmaker didn't know how to qualify and code, the expenses in the QR qualified report.

Alex Ferrari 28:42

So it could have been you could be adding, there's other things you like, it's basically like going into having a forensic accountant or just an accountant go in and go, yeah, you you could have saved another $10,000 in taxes this year, because you didn't expense this properly, or expense that properly.

Zachary Tarica 28:57

Absolutely.

Alex Ferrari 28:58

So that's, that's, that's fairly valuable. Now,

Zachary Tarica 29:04

from our standpoint, what we're trying to accomplish, because the more we can maximize that value for you, the better your film is going to be. I mean, it's so simple and I take over simplifying things, but less stress and pressure will generally always equal a better product

Alex Ferrari 29:26

nooo. Stop it.

Zachary Tarica 29:31

So it's just one of those things where if we can alleviate and we can give you the comfort of a couple extra days of shooting a couple extra days in a timeline for delivery.

Alex Ferrari 29:47

A bigger star,

Zachary Tarica 29:48

a bigger star, a better trailer better music. That's that's what we bring to the table.

Alex Ferrari 29:56

Now what Okay, so this sounds great and we've been throwing around them million dollars as a kind of number, but what is the minimum requirements to take advantage of tax credits because I know every state's different, some states won't even look at you for less than a million. And some will look at you for half a million, what is the kind of the kind of range, because I'm imagining a $50,000 indie film is not qualify for tax credits as a general statement.

Zachary Tarica 30:33

So what's interesting is that the states and we've been very active in promoting this, the states that we work in, and then I'll, I'll go through a couple now, they've done a great job of putting programs in place for the sub $200,000 film. And so what we've discovered, and actually, as part of a study that was done in conjunction with the University of Utah, was, we found that whether you're a $200,000 movie or a $2 million movie, there's still the same amount of effort and job creation and line producers and accountants and lawyers. And, and so we felt like there was this unfair bias to Well, it's got to meet this criteria of 2 million. Why? Actually, we've seen that on a $2 million movie, they actually have less people than the $200,000 movie. And so Louisiana has done an incredible job of building out their program for these smaller films. New York has done a great job, you know, promoting areas outside of Manhattan, Long Island upstate, for programs that are sub a million dollars. And I think the more that these programs can grow in Ohio, in Massachusetts, Kentucky, had this type of program, but recently shut it down in 2018. And 19. I think they will, I think people will realize that that they belong at the states at a lower budget range.

Alex Ferrari 32:31

Now, in your on your site, you talk a lot, you talk a little bit about buying and selling tax credits. Can you talk a little bit about that?

Zachary Tarica 32:40

Yeah, so we talked about New York where you actually get a check in the mail or rebate check. Right? You Alex made that movie 500,000 qualified, he finds out at the end that she wasn't a vegan. And the move is

Alex Ferrari 32:55

a horrible, horrible romantic, romantic comedy, horrible romantic comedy.

Zachary Tarica 33:01

Yeah, exactly. And and you get your check in the mail for 150,000. Everyone's a winner, you're all happy? Well, what happens when you don't get a check in the mail? What happens when you have a credit that you need to monetize? So what happens there is you need to find someone with income in that state. Because they're going to utilize the tax credit to offset their tax expense. And so let's just use Georgia because we talked about it before. Disney makes a lot of movies in Georgia. Disney has no income in Georgia. Therefore, they do not pay any Georgia state income tax. However, a lot of other companies do make income in Georgia, Coca Cola, delta, Cox Communications, Georgia Pacific. chick fil a, those companies do want to use those tax credits. So Disney earns that right? They generate them because they make a movie in Georgia and delta, bad example in the environment because they won't have much taxable income for the foreseeable future. But a company like Delta let's use Home Depot where everyone is improving their home right now because Guardian travel I did for for six months, yeah, eight months. And and they will buy the tax credit from Disney at a price where there's a spread in the middle. So Disney earns a tax credit. And then they sell it to the addressable market, ie the income earner. And what we do as a company is we connect buyers and sellers.

Alex Ferrari 34:57

So if I have, okay, so if I have $100 Tax Credit. I'm Disney, and I'm gonna sell it to, to Home Depot. I'm assuming I'm not selling it at $100. I'm selling it at a discount.

Zachary Tarica 35:10

Correct

Alex Ferrari 35:10

And now does Disney is there no other way Disney can use that money? Is that credit?

Zachary Tarica 35:16

There's no, there's no other way they can use it.

Alex Ferrari 35:19

Okay, so they have to go down this road

Zachary Tarica 35:22

They have to sell it. And so the market for Georgia tax credits right now is 88 to 91 cents.

Alex Ferrari 35:33

Okay.

Zachary Tarica 35:34

So it's got to trade at a steep enough discount for the buyer Home Depot to want to earn a return. So if you buy something, let's just use round numbers. If you buy something at 90, you just save 10% on your taxes.

Alex Ferrari 35:51

Right? And you want to buy as many of those as they're available?

Zachary Tarica 35:56

Well, in theory, you want to buy as much of it of the taxable income you have,

Alex Ferrari 36:00

right

Zachary Tarica 36:01

So that you can pay as little in state in income tax.

Alex Ferrari 36:05

So for the cost of 10%, they get to write off 90% of taxable income.

Zachary Tarica 36:12

Well said a little bit differently. Yes, you get to buy something at 90, you get to buy a million dollars of taxable liability for 900,000. So you've solidified you've crystallized a profit of $100,000.

Alex Ferrari 36:28

Got it

Zachary Tarica 36:28

Taking no risk?

Alex Ferrari 36:31

Well, that seems Is there a place for personal income like that, sir? can we can we do that? Or is there is there a place that we the the poor, independent filmmaker trying to scratch out a living here in Los Angeles? Because God knows LA doesn't have any taxes? We could purchase some

Zachary Tarica 36:47

California is is I don't want to go on the record for speaking poorly of California. But California is a good example of a state that doesn't have great tax credit programs for the film industry. Unfortunately

Alex Ferrari 37:03

No and it's been like that forever. And I know whatever tax credits there are, they get gobbled up by the studios.

Zachary Tarica 37:11

That's right. It is very hard for the independent film community. Despite our lobbying efforts, and what we have tried to accomplish working with the Film Commission and others, to have tax credits a lot of to the small indie filmmaking community. It's just, we just haven't had great traction and success.

Alex Ferrari 37:36

But there's plenty of places in the country that you can, can do that. Nowadays. And you know, things might change. Like, you know, I right now there's an exodus out of California. Yeah, there's an exodus leaving California because taxes are ridiculous. And now, I just just as a general statement, this is a little off the record off the topic. But the whole, our whole industry has changed so dramatically now, because the work from home model is now established. And employers like it, employees like it, it's less cost for the employer. It's more convenient and more productive for the employee. that's changing so dramatically. And then all of a sudden people living in large cities, especially in our in our it may be different for crew people, but people who live work behind the scenes or other things like that. They just they just like why am I spending obscene amounts of money living in LA in New York, Chicago, when I could just move to Georgia, where I could, I could buy a mansion for the price of a shack here in Los Angeles.

Zachary Tarica 38:43

I know. I do believe that. There are a few cities in in the United States right now that are going to have a tough time digging out of this hole that is created for them and those cities, as you look at them on a map, and you look at the percentage of the city that is taken up by the three R's, retail, residential, real estate, and restaurants. And any of those cities are not going to be able to bounce back in the way that other cities can and and on top of that. The tax rates in California and New York are going to go higher. I mean, I don't know how else to say it. And, and to me, it speaks volumes to why tax credits will become a more prevalent part of society and are in and community. But most importantly, I think it will just be tied to where people end up going to I think you will see a flight out of Manhattan, I think You will see a flight out of Los Angeles. I just I don't see how it's how it doesn't happen that way.

Alex Ferrari 40:09

No, Zack, can we talk a little bit about tax credit fraud? Because I have some personal experience with that. And I would love to hear some of your stories, and I'll be more than happy to tell mine.

Zachary Tarica 40:23

The tax credit, um, well, tax credit fraud. So let's start with there is a ton of it out there. And and I think maybe even taking a bigger step back. We talked prior in one of our earlier conversations, just the barrier to entry in the film industry. And I think what is unique is, you know, you want to be a dentist and you go to dental school, you want to be a lawyer, go to law school, you know, if you want to be a filmmaker, you just show up and you change your LinkedIn profile or your Facebook pitch. And so you will always deal with bad apples and this industry, like all others have the bad apples in it. And so fraud, especially in tax credits, is, I think, the most notable or relevant thing to talk about when you do talk about tax credits. I think most of the time, the filmmaker genuinely doesn't even realize they're committing fraud. And I think the examples that I would cite on this is examples where they did know that they were committing fraud, because look, at the end of the day, when you're working hand in hand with a state Commissioner, film office and accountant, a lawyer, you're gonna make mistakes, and hopefully, using far sword as a company, we can help avoid those mistakes. But the reality of situation is they're gonna happen. I think they become big issues when there's fraud. So what is tax credit fraud? It's actually pretty simple. The most notable form of tax credit fraud is related party transactions. So Alex moves to New York a month before he makes his movie about the vegan chef romantic comedy. And Alex buys three vans, we'll just make the super simple three white vans, and Alex charges. Every time an actor lands at JFK Airport, Alex jumps in his van, he throws on his little driver hat and his suit. And he picks up George Clooney from JFK. Right? It comes time to hit all the expenses. And Alex submits the expenses for the tax credit. And he says that every time you picked up George Clooney, or whoever was in the movie playing Alex in this romantic

Alex Ferrari 43:16

Thank you, sir.

Zachary Tarica 43:20

And he charges $100,000 to pick up George Clooney from the airport. No, no. Why would Alex do that? Well, Alex is the sole member of Alex transportation company, the white van that picked up George Clooney from JFK. And so you're saying yourself? Well, that's not fraud. I paid myself $100,000. From the money that I raised from investors. They didn't ask who or what I was doing with the money other than to say I was making a movie and I qualified that for the tax credit. Well, the problem is, is that the state is going to pay you a rebate amount off of the total amount that you spent. And in reality, it should not have cost you $100,000 to pick up George Clooney from the airport. Maybe it should have cost you $300. So that is the most relevant for our form of a related party transaction that is fraud. And so what happens is, is back to the numerator denominator, you are taking point 330 percent of the tax rebate, and you're multiplying it by the qualified expense of the film. And so if you only spent $300 at a 30% rebate, versus $100,000 at a 30% rebate, well, you just sold, you just stole about $29,000 from the state of New York. And so that is fraud

Alex Ferrari 44:57

and that it's also a federal situation. I'm not mistaken, can it?

Zachary Tarica 45:02

Well, it can be where we've had great experience is at the state level, where not only was it a related party transaction, but there are things like changing general Ledger's and cost reports.

Alex Ferrari 45:20

You mean having two sets of like two sets of books, like like the mob?

Zachary Tarica 45:23

to exactly, there's, there's two sets of books, there is, you know, we've seen a bunch of different things, I would say, the most common is not two sets of books, but we've actually seen just outright made up numbers in a cost report. And so the way accounting works really high level payroll providers, production accountants, are creating statements, both cost reports in general letters. And so if you are submitting material to an auditor, generally a third party auditor, and that auditor is using fake numbers tied to a mis represented costs report, which then created a fake general ledger, which then created a fabricated audit. That is fraud. And, and it goes all the way up, you know, potentially to the federal level, because what happens is, is that the auditor is being hired by the state to do the state's work. And so when the auditor doesn't catch the fraud, it becomes the state's problem. And when it becomes a state problem, it becomes a big problem.

Alex Ferrari 46:47

So I've actually heard of companies and tell me if this is actually legal or not, I've heard of this, in the years of me walking around in this business, were like, okay, we're going to go shoot this movie in Louisiana, because Louisiana has really great tax incentive, we're going to set up a post house in Louisiana, and we're going to open up a company that's going to do all the posts there, we're going to fly people in, and it's going to be a Louisiana post company. So we can qualify all that expense to the tax, the tax credit. And we're going to keep that company going for a few years doing other projects and stuff like that, because we're going to keep coming back. Is that legal?

Zachary Tarica 47:23

That is not only legal, that's a that's a great thing. Right? Okay, because that creating jobs, that's awesome. Here's where it becomes not awesome. That same example you gave, we're going to go to Louisiana, we're going to open up a post production company, and we're going to create jobs and it becomes not cool or not legal, when you don't disclose to the state, that it's your business. Right. So if you open that post house, right, and your form is also using it, what the states do, which I think is smart on behalf of the states is they cap the amount of tax credits that can come from related transactions. So using your example of Louisiana, it's great that they build a post house that they're creating jobs. However, what if the VFX normally would cost $100? And they're charging $100,000? Sure, same thing. Yeah, it's the same thing. As long as you can show, look, this is market. This is we're doing things the right way. Then there's a cap on how much that can be. So another good example is in Illinois, right? They have a post credit. So what you have is you have Principal photography that goes in Kentucky. And then you've got post production that goes in downtown Chicago, but now they're trying to qualify the entire expense of this post job. But we all know that some of it was done in Los Angeles and we all you know is especially in a world today where you can do a lot of this stuff from a lot of different places. So the states constantly need to be changing. And amending and working with production companies and working with lenders to make these programs more efficient and better.

Alex Ferrari 49:33

Because I've heard I mean I've I've been a party to I have not say I was involved in but I've heard of something setting setting up a company like that in Louisiana and then all of a sudden using let's say an LA or New York VFX guy and paying them the you know to do the majority of the work but funneling it through that post house that's now in and that's that's fraud?

Zachary Tarica 49:57

That is fraud.

Alex Ferrari 49:59

Straight up.

Zachary Tarica 50:01

Straight up. Yeah. And so generally and it's it's tough to stereotype, but when we hear words like in kind or funneling or defer or related party, our ears perked up a little bit, because we're trying to, we're not we're not trying to ruin anyone's day, but we're trying to steer people clear of of the danger that they can get themselves into and, and oftentimes are led into by some people in this industry, that better not having their best interests.

Alex Ferrari 50:41

So I promise that I promise I will tell you, My my, my tax credit fraud stories, which are terrifying, because I was sitting around selling olive oil, because I used to sell olive oil when I got out of the business for three years. And that's a whole other conversation for another day. I was sitting there and all of a sudden I get a call on my phone or like, Hi, is this Alex Ferrari? Oh, yes. And like, this is the FBI. And I'm like, No, seriously, who is this? I'm like, No, sir. This is the FBI. I'm like, I'm sorry. What would you What can I do for you? They're like, did you work on x movie? I'm like, yeah, Yes, I did. Because Do you know this person, this person that this person I go? Well, yeah, they were the producers of the film. We're flying in to talk to you. The term we're flying into talk to you from the FBI is not something you want. It's scary because they like it. This is like, we have to do this in person. We can't do this over the phone. So that I was like, Oh my god, like, Where can we meet you? I'm like, just beat me at my olive oil shop, I guess. So. We, they fly in? And they tell me like this guy did this, this and this. And we're just trying to figure out where the money trail is. How do they pay you this? And that and like, what what's going on? They're like, well, we really can't say, but these guys have been indicted. You can't say anything? I'm like, No, no, no, I'm not gonna say they've been indicted. And we're building the case up against them. They're currently under arrest. And we're doing this, this and this. And I was like, Oh, my God. And they, it was fascinating to see what happened. They went to jail. These guys went to jail for tax evasion. And I won't say what the state that they were in. But it's when I when I told you this story. You're like, Oh, it's this date? I'm like, yeah, it's that's it. But we won't say this date. Yeah. But that was one. And then another one, I was doing post on another job, which was a three or $4 million movie and had a big star that everyone would recognize their name if you heard it. And the director, who was also the producer stated that they that in their cost reports, which I don't even know how you can add that as a tax credit, because it's a salary, I guess it was a rules of that state. Because it's the salary of an actor who lives in Los Angeles. I didn't know how that worked. But whatever. He said he paid him 1.5 million. And in reality, when the actor was asked, the actor said, No, no, I was paid 300,000. And the guy went to jail for like, a year and a half in a federal penitentiary for tax fraud. And I was just like, oh, my, I'm like, this guy was sitting in my post suite, we would talk in the gym, and it was like, This is serious. It's serious guys happened.

Zachary Tarica 53:16

And and and these, you know, producers, they hear, oh, well, you can give, you know, actor XYZ a million dollars, and then have him reinvest 700,000 in the movie, and so instead of the 300,000, that would have qualified for the tax credit, the million is, quote, unquote, qualifying. And that's broad. I mean, that's illegal. And, and it's important for all of us to know the rules and to understand the consequences, that, you know, when you when you mess this up, you're not dealing with, you know, the dentists that lent you 100 grand, you're dealing with the state of New York, California, Georgia, you know, it's it's the state of New York versus and, and that's a scary, that's a scary letter to get or phone call to get for sure.

Alex Ferrari 54:16

Now is this. So you obviously would recommend if you're going to go down to tax credit road, to really partner with someone who's done it a serious serious company, and or producer who has vetted experience? And you can you can do the homework and check what they've done and see if they're real and do your homework. Because if you try to do this on your own, you'll never, you just can't

Zachary Tarica 54:43

wait, I think I think you look, I don't want to belittle anyone, right, you could if you wanted to. The question is, is you have a lot of when you're building this business, your film, there are only so many hours The day and having been a part of a lot of these, I get that you are working 24 hours, seven days a week until this thing is born. And the question you have to ask yourself is, is it a good use of my time to be reading the statute in New York, you to be filling out the endless amount of applications, and going through the final application process and the audit process and, and so what I would say to any of the listeners, when you're contemplating taking money from anyone, but but especially in something where you are not going to do the work yourself, I can say whatever I want to the first require them to walk through with you the deals that they have done, and give them the ability to put you in touch with their borrowers. The selling point that I give for Forest Road, is I'm not going to pitch you on what we do. But I'm going to give you a list of the 150 projects we've done in the last however many months, call them. Ask, here's their email address, ask them about it. Because whatever I say to you, you're not really going to underwrite to anyway, because I've got an agenda, and I'm running a business and I want to make money. So call them and ask that we turn down projects, because projects don't make sense for the borrower, for you, the end user, make sure you're working with someone that's going to do the same. Make sure that if you're doing a deal that it makes sense for them, because it has to, and no one's expecting charity, but that you understand what you're getting yourself into and how it works. Uh, that that to me, it's just not a good use of a filmmakers time to be the one doing all this tax stuff in air quotes. That's, that's what I would go.

Alex Ferrari 57:13

Well, I mean, it's the equivalent of like, I'm generating a million dollars in income and using TurboTax. As opposed to or using an accountant, could I do it? Yes. Now, if you're making, if you're making $50,000 a year, and you don't have a lot of it's not very complicated. TurboTax is perfectly acceptable. But if you're making a million dollars, or you have a million dollar film, and doing it yourself is the equivalent of doing TurboTax. And you really should get an accountant or someone who knows what they're doing to help you save money, because they're gonna see things that you won't see. And whoever that whoever that is your company, if it's another company that another individual that knows what they're doing, you should really reach out to these people. And I obviously your company is a front and center here.

Zachary Tarica 58:00

Look, I would go back to every dollar invested in a film is a risk dollar,

Alex Ferrari 58:08

it's all risk.

Zachary Tarica 58:11

So and so the app on its face, there is riskier parts of the capital stack, ie the equity. And then there are safer parts of the capital stack me the MG from Netflix, right. And so no matter how you cut it, there is risk involved. What I'm just saying is, if you partner with the right person on the tax credit, you can mitigate that risk entirely, and focus on other parts that are of more risk. So if you don't partner with the right person on the tax credit, and it takes you five years to get your money back, what will likely happen is you will end up losing money on other parts, like the equity will get hurt because of the interest expense of the tax credit loan. And so pick your spots as the CEO of your film on where you want to allocate the resources is that maybe a little bit differently. What makes a great CEO is their ability to invest capital, and then in human capital. So you as a filmmaker, you as the producer of this title, you need to pick where you want to spend your energy, both on the investment of dollars, but also on the investment of people and the product offering that forest road gives is the ability to bet on us that we cannot only maximize the value of the tax credit, but get it back faster to you than anyone else in the market.

Alex Ferrari 59:55

Now that's the that's the quote. Why does it Why would it take so long? What I mean? I mean, you're working with government, so obviously government's very speedy and efficient. And it's it's super efficient and nothing ever goes wrong. So I don't know why it would take long. But I understand it might be, you know, a year, two years, but four or five years down, like, what causes that? And what do you do to speed that process up?

Zachary Tarica 1:00:30

So, the number one thing that causes delays, I'll use the college admissions example. If you were to apply to college today, and I don't actually know what it would entail, and I feel like in this COVID world, who knows what is required, and with with standardized tests, etc. But let's use the let's use the pre COVID model for applying to college. You have your high school grades, you have your extracurricular activities, you have your standardized tests, you have the big three, then you have the sub tier things, your essay, and the questions Why? Why do you want to go to the University of Michigan, and you have those as sort of the sub tier things. Now, if you submit everything all at once, in one beautiful binder, and presented to the university, the likelihood that you will get in if you have the goods, if you have the grades, you got the essay nailed. And you did well on your tests, you're going to get in if you apply with your decent grades, but you left out the essay, or your essay, but you left out the standardized tests, guess what's going to happen, the University of Michigan isn't going to call you to remind you to send in the essay, they're going to sit on your application, and you will never hear from them. And then you will wonder why you didn't get in? Well, the difference is is that with college, you have a time period in which you know you need to apply and then accept and then enroll and then event with tax credits, you'll sit outstanding in perpetuity forever. Because because you still haven't sent in your Ei n number or you still haven't submitted your operating agreement or you still haven't finalized the payment to the auditor, and the state isn't there to remind you to do it, the state's not signing up to give you money. So if you don't do it, right, I promise you, you'll never get it. And so the difference between four years and four months, is making sure you did it right and making sure you have someone to hold your hand and take you through that process, right so that everything gets delivered timely, in a way in which the state can respond to a timely,

Alex Ferrari 1:03:04

it's similar. It's similar in post where if you've never delivered a movie before, to a distributor or to a streaming service, and you do it all yourself, because you saw some YouTube videos. That's one way. And then you're going to be going back and forth with QC issues and audio pops and technical things. Because you haven't gone through or you hire a post supervisor or an online editor who's done it 50,000 times you pay them a little money and they make sure everything gets done right. Yep, it's it's it's just Pennywise pound foolish basically.

Zachary Tarica 1:03:37

Exactly right

Alex Ferrari 1:03:39

now is with COVID man How is COVID changing the business right now for you guys? Because obviously production is unless you're Tyler Perry on the Tyler Perry lot. It's It's It's a little rough right now in the in the US.

Zachary Tarica 1:03:52

production companies are treadmills, right, they work as long as they're turned on, and they're keep and they keep going. And so COVID has halted that. And we've stopped. Now we actually do have four productions that are in principle photography right now. Which is crazy. I, I do not like risk that much. But if you're making a movie today, you are taking big risks huge. On top of which we as a firm don't require a bond. So we've been busier than ever. And that's great. But it's risky. Right? And so, for us, we are looking at a couple different projects. They're going in Georgia, you're going in New Jersey, we're going in Puerto Rico, and we're pumped to be a part of them and excited about being a part of them. But it is scary for sure. And with the union guidelines and the state guidelines, and the the risks of running false positives, and the

Alex Ferrari 1:05:11

reduction

Zachary Tarica 1:05:12

actors that are in an age gap or constraint where there's real risk to their health and well being, it's scary, for sure. And I don't see it changing for a long time, I think. I think obviously, we're not on this podcast to talk about a vaccine, but I don't see any part of the Union guidelines or state guidelines changing until a vaccine is acceptable

Alex Ferrari 1:05:45

to them, and, and tested for six months to a year to see what really happens. I've been, I've been saying that forever, and people are like, Oh, don't be so negative, I'm like, I'm not being negative, I'm, I'm preparing for the worst and hoping for the best man. But I think we're at least 2022 before things start to even remotely, really start to come back up. But to come back to pre night, pre 2020, it's gonna be it's gonna be yours.

Zachary Tarica 1:06:13

Well, it's, it's a good example would be like, buildings, right? So I'll, I'll make up an example, I don't even know if this is true. But you have buildings that are all made of wood. And then one day, someone says, All new buildings that are this high need to be made with steel. And so this transition from wood to steel occurs, well, if steel is more expensive than wood, which it normally would be in that period of transition, the price to make content I'm using as a building, ie we're building. And so right now, pre production is a lot more expensive than pre production, pre COVID. transdermal water V is a lot more expensive than it was pre COVID. So the cost of making content is going higher, at the same time, that demand for content is going higher. And I think that that is a great opportunity for your listeners. And for the producers out there that want to make titles want to make content, we just need to create a way to do it safe, and we need to work with state, both local and federal governments to do it the right way. And we need to make sure that not only are we doing it the right way, but we're also doing it the right way for the investors too, right. Like the the making the $10 million movie that only has the resale value of a million dollar Hallmark. And product is not a good idea, you may have made it safely. But it's not going to end well for your investors, and therefore it's not gonna end well for you. And so that's the second, you know, negative here.

Alex Ferrari 1:07:56

And when you when you send your book my book around to everybody in the company, you also do real estate and energy credits, as well. Um, can you please tell everybody, can you please tell everybody what the other two departments said to the filmmaking department?

Zachary Tarica 1:08:15

So so the quote that I got in an email is, why does anyone waste their time working in this industry? dot dot dot, wolf.

Alex Ferrari 1:08:29

And that was probably just reading the first chapter.

Zachary Tarica 1:08:32

That was probably that was probably reading just the title page or the back of the book with with the quotes, right. So still, yeah, I look, every industry has its headaches. And we as a company, we like to focus on correlating our headaches with our returns. So if we make 80% of our money in the real estate industry, but film is 50% of our headaches, that's a bad. That's a bad business line item for us. So we like to make our headaches align with our profitability. But that being said, I know some of the other members of our team on the real estate and renewable side that bet did very much, at least enjoyed some of the chapters in this book, as it pertains to some of the horror stories that uh, that you both and your reader have lived through.

Alex Ferrari 1:09:32

Yeah, and that's the thing I want people listening to understand when when you're talking to investors. It's a very specific kind of investor who invest in in in motion pictures. Because unlike real estate, at the end of the day, you have real estate. Like you have a tangible product that you own, whether the market goes down or up. You have land, you have a building in one way, shape, or form. When you make a movie, even if you've got a sucky building, like it's badly designed, it's still a building, it has some sort of value to it inherent value to it. Whereas in a movie, if the director was bad or ego driven, or the movies horrible, and it's not marketable, there's essentially no value there. And you've basically burned a million dollars, you hopefully have enough people on your team that can kind of mitigate that risk, by story, by talent, by genre by other things like that, to actually make it a viable product. But I want people to understand it's like, it's a specific kind of individual who wants to invest in movies. And I'm sure you deal with these these guys all the time. Because it's an there's endgame different end games, some guys just want like, Hey, this is fun. I'll throw I'll throw in a half a million dollars. I just want to be part of a movie, that'll be kind of cool. Can I go to a red carpet or you know, meet some cast and be on the set, it gets cool. And other people are in it for the money, which still, to me, it's like, if you have a million dollars, would you invest it in a film? Or would you invest it in real estate? Or would you invest it in any other million kinds of investments? It's it's really interesting. And you coming from what I find fascinating, you come from a financing background, you do not come from a creative artistic background, obviously with that pitch. That's very sad. Obviously, that's very evident. But no offense, sir. But but the but if you're coming from finance, and yet you decided to open up a shingle underneath this, this company for film financing. The reason why was because again, this is crazy. It's just crazy business where it's insane, ridiculous, upside down business. I understand why I'm in it because I was infected with the film bug 25 years ago, once you once you get it, you don't get it, get rid of it. And there's a passion behind it, because I'm an artist, as well as a businessman. But you're a straight A business guy. Why did you do this?

Zachary Tarica 1:12:10

Yeah, I Geez. If you ask me on the wrong day, I'll say I'll tell you that, that I still don't know why I did it. I I think so. I got into it in a way that was just bizarre, right? A friend had asked if I would look at his investing in his film.

Alex Ferrari 1:12:31

By the way, did you invest in that movie?

Zachary Tarica 1:12:34

I did not.

Alex Ferrari 1:12:35

Okay, good. So you're okay. That That says a lot about you, I just wanted to know, because I'm I don't know who I'm talking to.

Zachary Tarica 1:12:42

I did not. And, again, just going through the motions of I ultimately ended up doing a tax credit deal with with on this first one. But what ended up happening was just this ultimate curiosity with how this could work and creating this situation where the state could win, our company could win, the filmmakers could win, and us to earn an adequate or a good risk adjusted return. So I think, you know, in looking sort of like why we're in this industry now, it's worth noting, right, we do not ask for a credit in the film, we do not want to read your script, we do not want to be executive producers, we do not want to go to your premiere, we we are like the least sexy.

Alex Ferrari 1:13:43

That's amazing,

Zachary Tarica 1:13:44

you know, film investors you will ever meet. And so we really just like the notion that we can add value to the title and the business, and also the state and make a good return on our investment. So

Alex Ferrari 1:14:05

Go ahead

Zachary Tarica 1:14:07

So from from the standpoint of, you know, why are we doing this, and so we're doing it because we've done over 150 films in a really short period of time. We've put it this year alone, close to $90 million to work in this industry, in the film industry, or in the entertainment industry, I should say. And there are a lot of projects that would have never shown up on your television during COVID or in a movie theater near you prior to March. And it's pretty great to see the jobs that it's created. It's great to see the excitement and the underlying content that exists because of our business and not to mention we've we've made we're not out here to do for free, we're making money. And we've made great returns for our investors in the company as well.

Alex Ferrari 1:15:06

Because, you know, I've, I've talked to sales agents who, who not only want a credit, but they they want an executive producer credit, they want portions of the IP, they want a percentage of the the underlining IP, they want their logo in the front of the is a producers reps that do the same thing, let alone distribution companies, you know, and getting credits for them and stuff like that. It's It's refreshing, sir, it's refreshing.

Zachary Tarica 1:15:33

You will not and maybe maybe to our fault, you will not find our name out there because we are not, we're not the ones that put in the blood, sweat and tears into making it so we are not going to ask for credit. We are not going to be executive producers. We will we are excited in our involvement in the capacity we get involved in add value. And that's it. There's there's no strings attached.

Alex Ferrari 1:16:03

I it's It's unheard of what you're what you're doing, sir, you're actually leading with with your financial mind and not the ego, which is a very, it's just strange to talk to someone like that on in the business. It's just because I've just I've just talked to 1000s and 1000s of people in this industry. And generally speaking, I've met a handful I could probably count on one hand who are just, I'm just about the business. Because we're just

Zachary Tarica 1:16:31

Becasue we are just about the business. Yeah, I again, sometimes it doesn't work because I go into a meeting and someone wants to talk to me about you know how amazing that actor did on that day shooting. And I don't know the actor they're talking about. They're referring to when they're talking about what stage they're in, in principle. And I'm just sitting here saying like, Look, I love that you're so passionate excited about it. But can I go back to you know, creating my general ledger, and making sure that we do everything the right way so that we can get your tax credit back quick

Alex Ferrari 1:17:05

And that's kind of you don't want the guy who's doing your tax credit to be, you know, on set, you know, I don't want that guy.

Zachary Tarica 1:17:12

I never understood that. Like, why do you want the accountant there? Why? I mean, I guess you don't? But why should why did they think they should be there? Like, what what what right? Do they have to be, you know, as the tax credit lender or the broker or the servicer? Why are they on your set?

Alex Ferrari 1:17:32

Because everybody and their mother wants to be on set is a general statement. I've had it 1000 times like, Hey, can I come down to set one day while you're shooting? Can I do this or that? It is just the nature of our business because we are arguably one of the sexier businesses out there in the world. And Hollywood has done an amazing job selling that sizzle over over the last 100 plus years. And that's what people people you know, and that's why there's as we'd like to call dumb money, who who put in money into a movie because they just want to experience that. That experience. It's It's It's a fascinating.

Zachary Tarica 1:18:12

Yep,

Alex Ferrari 1:18:13

It's Look, it's a fascinating business man.

Zachary Tarica 1:18:15

150 titles. Plus, I, personally, I have never stepped foot on a movie set in my entire life.

Alex Ferrari 1:18:29

Well, sir, if you and I ever do business together, I'm gonna fly you in. So this is the way we're gonna do. I'm gonna fly you onto the set. And then you're and then i'm gonna i'm going to use that as a tax credit because I'm going to fly you in. I'm going to try and pick you up in my van for $300,000 because I'm an expensive van service, and we're going to use that money towards a tax credit in Georgia.

Zachary Tarica 1:18:48

There you go. And we're gonna have to figure this out. And then I will pick up the phone and they will say, sir, this the FBI

Alex Ferrari 1:18:56

Have you? Do you know Alex Ferrari? Have you have you worked with him?

Zachary Tarica 1:19:02

Exactly.

Alex Ferrari 1:19:03

We we kid sir, we're kid if anyone's listening out there. We're kidding. It's a joke. It's just jokes, guys.

Zachary Tarica 1:19:09

It's just

Collect Alex. Not me.

Alex Ferrari 1:19:11

Hey, no, no, no, no, I just I just joke, sir. It's just jokes. I'm going to ask you a couple questions, ask all of my guests. But since you are not a filmmaker, I'm going to tailor them a little bit towards you a bit. What advice would you give a filmmaker wanting to deal with tax credits? In today's world?

Zachary Tarica 1:19:34

Ask dumb questions, because no one. When we hire someone at Forest Road, they get this period of time in which they can ask anything they want. We expect them to know nothing. And so because people think like, Oh, I know. Yeah, tax credit. Yeah, you get it back from the state because they do that they don't feel like they are asking, I am constantly asking the state the dumb questions. And so your dumb questions are not dumb. And they can make or break this whole thing. So I know that sounds cliche, if you are a filmmaker, first off, do not make any film without exploring both the local wherever you are located your tax credit and rebate options. But if you are making content or you're investing in content, the first question you need to be asking yourself is how am I maximizing this municipal product that can reduce the amount of money I need to raise? And then the second part is, I need to hire the right people or partner with the right people? Or do the work myself to make sure I fully understand everything that needs to happen to do this the right way.

Alex Ferrari 1:20:57

Now, what is the lesson that took you the longest to learn whether in the film business or in life?

Zachary Tarica 1:21:06

Well, let's see. I learned this one. Recently, having never wanted to actually be an entrepreneur and start a business I love working for someone else. I love just being a soldier and, and marching orders and following them. No matter what you're investing in people, until you really understand that you don't get what investing is, it could be the best idea. It could be the most Sure. fire proof investment, it's bullet proof no matter what you're going to make x no matter how you cut it no matter how smart your lawyers I've got the best lawyers in the world that have paper this thing no matter what you're investing in people and until you underwrite to that and get it nothing else matters.

Alex Ferrari 1:22:02

Absolutely, I mean, if you watch Shark Tank, you see it week in and week out. It's these guys invest in people. Exactly. They're very smart. And I've seen so many investors who go you know, we want to invest in this filmmaker. They might not be the most experienced they might know this but they have a vision and I think they could bring it to the table and let's help them get to where but we're going to invest in this person as opposed to the script only or things like that. It's all about the it is all about the people now and of course three of your favorite films of all time, sir.

Zachary Tarica 1:22:36

Wooo this is. I haven't watched I haven't watched many. I'm

Alex Ferrari 1:22:43

You are kill killing me smalls. You're killing me smalls. And you don't even know that reference because you haven't seen that movie.

Zachary Tarica 1:22:50

I tell me what movie that's from now.

Alex Ferrari 1:22:52

Sandlot

Zachary Tarica 1:22:53

I will tell you if I saw it

Alex Ferrari 1:22:53

Sandlot,

Zachary Tarica 1:22:54

I have seen sandlot it was it was a long time ago, but I've seen it.

Alex Ferrari 1:22:59

Okay.

Zachary Tarica 1:22:59

Um, okay. Three of my favorite movies. Forrest Gump. Brilliant.

Alex Ferrari 1:23:05

Sure

Zachary Tarica 1:23:05

Um, the music, the story. It's, it's got it all. Okay, so I'll categorize with, I like movies that have it all. It's got romance, actions, sports war, it covers all the bases.

Alex Ferrari 1:23:22

Really? It really does.

Zachary Tarica 1:23:25

Um, second one, I'm gonna go with goodwill hunting. And I'll categorize that one as acting just Robin Williams in that movie. That's mark. Like, that's just that's just pure genius. The third one. The third one, I will come trying to go with something like that, that maybe your viewers have not seen before or something off the run. Um, there's a documentary called into the arms of strangers. Okay. It is about the Kindertransport, which was basically during during the the Nazi Germany in World War Two era where the United Kingdom sent Jewish children on a train for them to have never never see their families again. To live in the homes of of UK residents, basically saved a lot of 1000s of Jewish children. It's a it's a documentary. That is a it's it's incredible. It won an Academy Award. I do not know what year it won. This is years ago. But it's an incredible story. It's informative, it is touching. And I just think I'm not a big dock person. But I would recommend it highly as as it covers all the bases of a great documentary, which is it is super informative and it's a touching amazing

Alex Ferrari 1:25:00

And where can people find you in the work you're doing?

Zachary Tarica 1:25:06

Our website is The Forest Road Co. I would say check out obviously your podcast and and, and everything that you're doing. Yeah, we, again, you won't find us on the 150 plus films unless you wait till all the way at the end of the movie where it says, You know, I think some of the filmmakers have put thanks for tax credit financing, you know, whatever, in their credits. But um, check out you know, the films that we've done. I don't know how you would necessarily search for that. I guess maybe

Alex Ferrari 1:25:44

IMDb? Oh, yeah, I'll put I'll put links, I'll put links to all of that. And in the show notes, You're horrible. By the way, you're a horrible promoter. If you say

Zachary Tarica 1:25:54

I would much prefer to promote you, then. Then our business I'm, I'm honestly, most of our businesses were I should say 100% of our business is word of mouth. So we do not market we do not do press you know any of that stuff. It's it's all ways in which we believe in whoever we've reached out to. And they've recommended us to fellow filmmakers, and everyone else.

Alex Ferrari 1:26:19

I feel that the phone and the email might ring a bit after this episode airs. So I need you to prepare yourself where we are.

Zachary Tarica 1:26:29

We are flush with cash and

Alex Ferrari 1:26:33

stop saying things like that Sir. Stop saying things like that. You don't know what you're saying? You don't know what's going to happen. I've warned guests before. I've warned guests before I'm like, Listen, don't stay stuff like this. Don't put your email out there. Because you're gonna get and I get I get a call back. And like Alex, I'm so sorry. You're right. I got like got 1000 emails.

Zachary Tarica 1:26:56

Well, I'll I'll do a better job of of the promotion. But I'm just is is, is we were really passionate about what we do. We take our job seriously. We, if you go to our website, the first thing that you will see is redefining lending. And we do want to redefine how this process works in this industry. And so forest one are not like forest Comm. Forest Road co dot com check out our website. If you look at film lending, which is the third thing I think in there, you will click on New COVID reopening updates, as well as anything below where you see state rankings, click on any state on this interactive map type in your email, we can send you a cheat sheet on how to make your film in that state. We will work in accordance with the Film Commission with you, we do all of this free of charge, we are just trying to help put the most money on the silver screen and help the filmmaker so that we get that repeat customer. We have never had a one night stand if we work with you once we will work with you again. And that's the goal.

Alex Ferrari 1:28:13

And it's it's no longer the silver screen. So it's the silver monitor. It's really it's really the silver iPad. it's it's it's a it's a rough state of affairs we're in right now with the silver screen. But that's another conversation for another podcast. Zack man, thank you so much for being so candid and informative and dropping amazing knowledge bombs about tax credits for the trip today. So thank you again, my friend.

Zachary Tarica 1:28:39

I really appreciate it. I'm a big fan of you everything that you're doing the knowledge that that that you're dropping on, on, on your listeners on the readers, the book, I can tell you not only helped us as a company, be a better friend to the filmmaker. But I think it also helped our clients and customers make better product and ultimately make more money in what they seek out to do. So a lot of appreciation to you for putting that together and for putting your work out there.

Alex Ferrari 1:29:11

Thank you sir, I appreciate it. I want to thank Zack for coming on the show and truly dropping some knowledge bombs on the tribe. Thank you so so much that if you want to get links to anything we spoke about in this episode and get more information on how you can get access to tax credits in your state or country. Head over to the show notes at indie film hustle.com Ford slash 447. And guys, if you haven't already, please head over to eye f h tv.com. And check out the over 2200 videos we have to help you on your filmmaking and or screenwriting journey. It is the world's first streaming service dedicated to filmmakers and screenwriters. That's at I FH tv.com. Thank you so much for listening guys. As always, keep that hustle going. Keep that dream alive. Stay safe out there, and I'll talk to you soon.

Sign up to receive email updates

Enter your name and email address below and I'll send you periodic updates about the podcast.

LINKS

- Zachary Tarica – LinkedIn

- Zachary Tarica – Twitter

- Forest Road Company – Twitter

- Forest Road Company – Facebook

- Forest Road Company – Website

SPONSORS

- Bulletproof Script Coverage – Get Your Screenplay Read by Hollywood Professionals

- Audible – Get a Free Filmmaking or Screenwriting Audiobook

- Rev.com – $1.25 Closed Captions for Indie Filmmakers – Rev ($10 Off Your First Order)